Employer Cpp Rate 2024

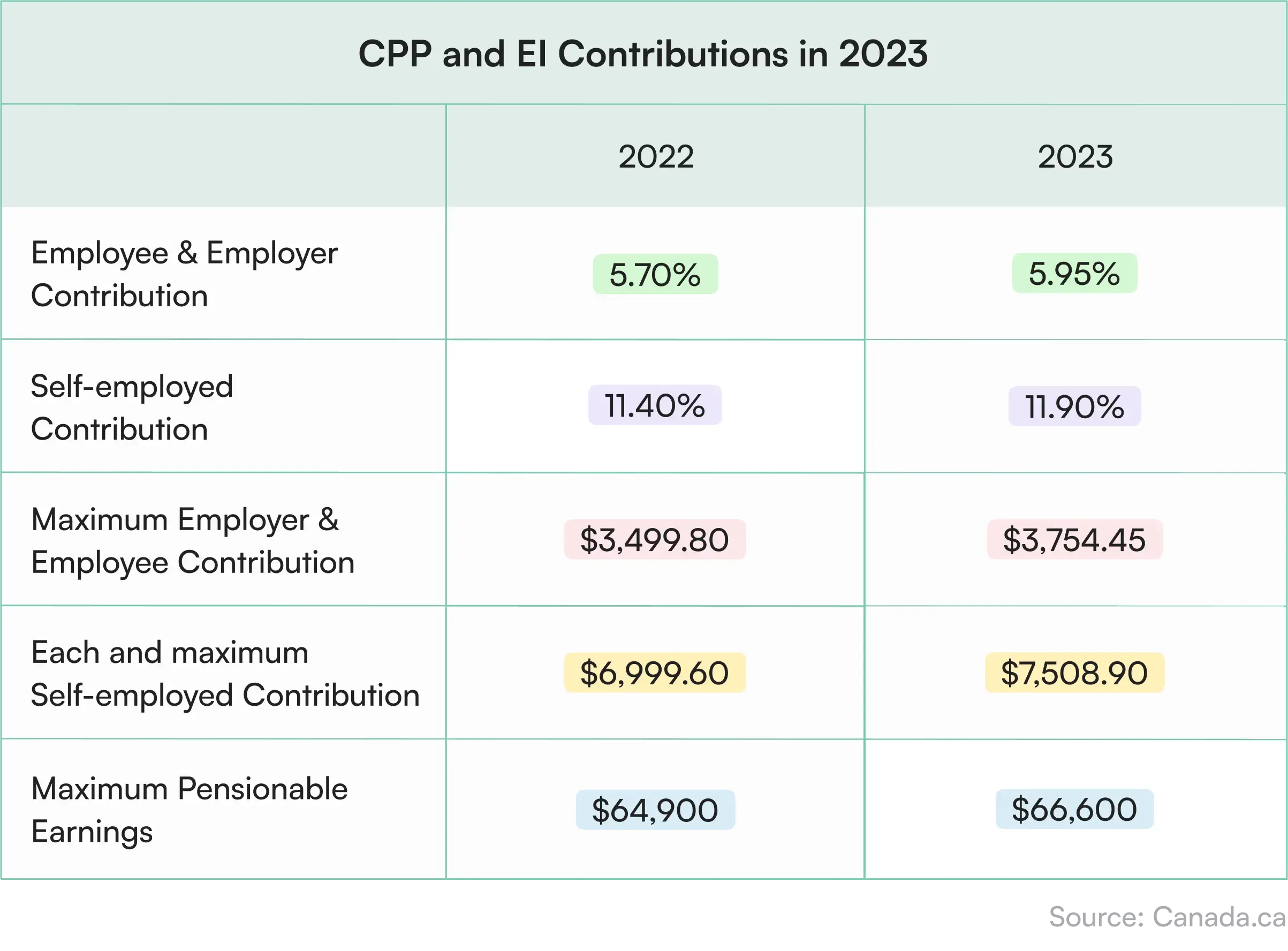

Employer Cpp Rate 2024. Employer and employee cpp contribution rates for 2024 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in. This means larger checks to the more than 66.

Which provincial or territorial tax table should you use? The employee and employer contribution rates for 2024 will be 5.95%.

In 2024, A New, Additional Cpp Contribution Is Required For Employees Earning Income Greater Than The Yearly Maximum Pensionable Earnings ($70,100 In 2024).

Maximum annual employee premium maximum annual employer premium definition:

This Is The Percentage Of The Employee's Pensionable Earnings That Both The Employer And.

How will cpp change in 2024?

There Are Three Main Changes To Cpp That Will Take Effect In 2024:

Images References :

Source: www.canada.ca

Source: www.canada.ca

Employers and the 2024 CPP changes Canada.ca, What if your pay period is not in this guide? Cpp and ei payroll rates and employer information.

Source: blog.hireborderless.com

Source: blog.hireborderless.com

CPP and EI Payroll Rates and Employer Information Borderless, Employer and employee cpp contribution rates for 2024 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in. Rate maximum annual employee premium definition:

Source: dollarknots.com

Source: dollarknots.com

Useful Facts About The CPF Contribution & Allocation Rates Dollar Knots, Rate maximum annual employee premium definition: How much do employers need to.

Source: cpaguide.ca

Source: cpaguide.ca

CPP Max 2023 Understanding CPP Contribution Rates, Maximums, and, The employee and employer contribution rates for 2024 will be 5.95%. Who should use this guide?

Source: metrocorp.com.sg

Source: metrocorp.com.sg

CPF Contribution Rates and AIS Metropolitan Management Services Pte Ltd, Employee and employer cpp contribution rates for 2024 remain at 5.95%, and the maximum contribution will be $3,867.50 each — up from $3,754.45 in 2023. Maximum annual employee premium maximum annual employer premium definition:

Source: www.planeasy.ca

Source: www.planeasy.ca

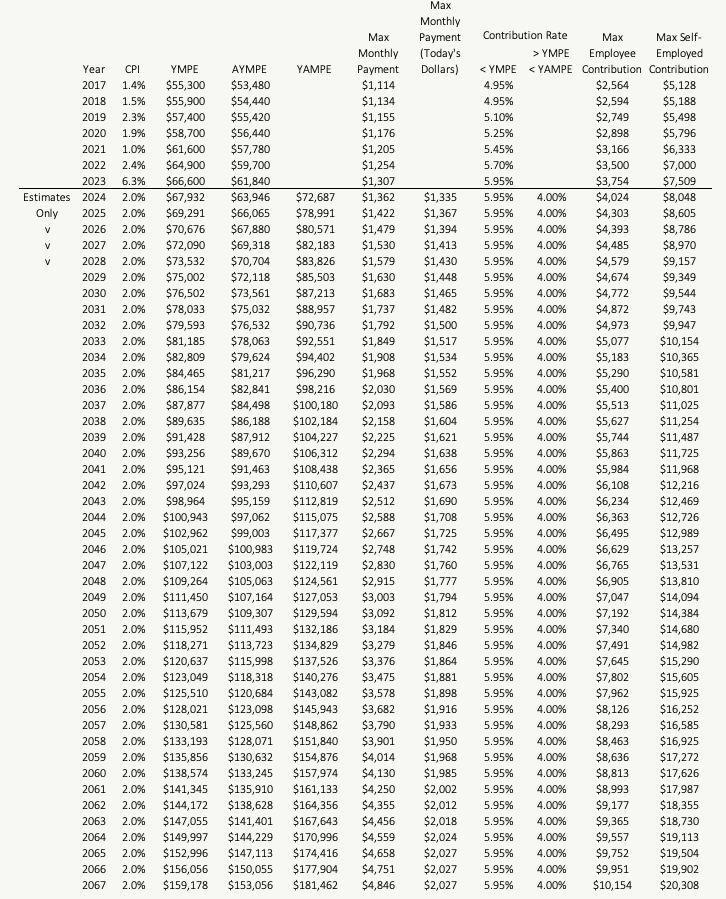

The CPP Max Will Be HUGE In The Future PlanEasy, This means larger checks to the more than 66. There are three main changes to cpp that will take effect in 2024:

.png) Source: www.hireborderless.com

Source: www.hireborderless.com

CPP and EI Payroll Rates and Employer Information Borderless, What is the cpp enhancement. Who should use this guide?

Source: cedarrockfinancial.com

Source: cedarrockfinancial.com

A Complete Guide to the Canada Pension Plan, For 2024, that means a maximum $188 in additional payroll deductions. How will cpp change in 2024?

Source: cpaguide.ca

Source: cpaguide.ca

CPP Max 2024 Understanding Canada Pension Plan Contribution Rates, Employer and employee cpp contribution rates for 2024 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in. In 2024, a new, additional cpp contribution is required for employees earning income greater than the yearly maximum pensionable earnings ($70,100 in 2024).

Source: snappyrates.ca

Source: snappyrates.ca

2024 CPP Payment Schedule, Amounts, and Increases, Employee and employer cpp contribution rates for 2024 remain at 5.95%, and the maximum contribution will be $3,867.50 each — up from $3,754.45 in 2023. Cpp and ei payroll rates and employer information.

Canada Pension Plan (Cpp) And Employment Insurance (Ei) Cpp Contributions For 2024.

Earnings between $68,500 and $73,200 will be subject to additional cpp contributions, known as cpp2.

How Will Cpp Change In 2024?

What is the cpp enhancement.